massachusetts real estate tax rates by town

The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value. They are expressed in dollars per 1000 of assessed value often referred to as mill.

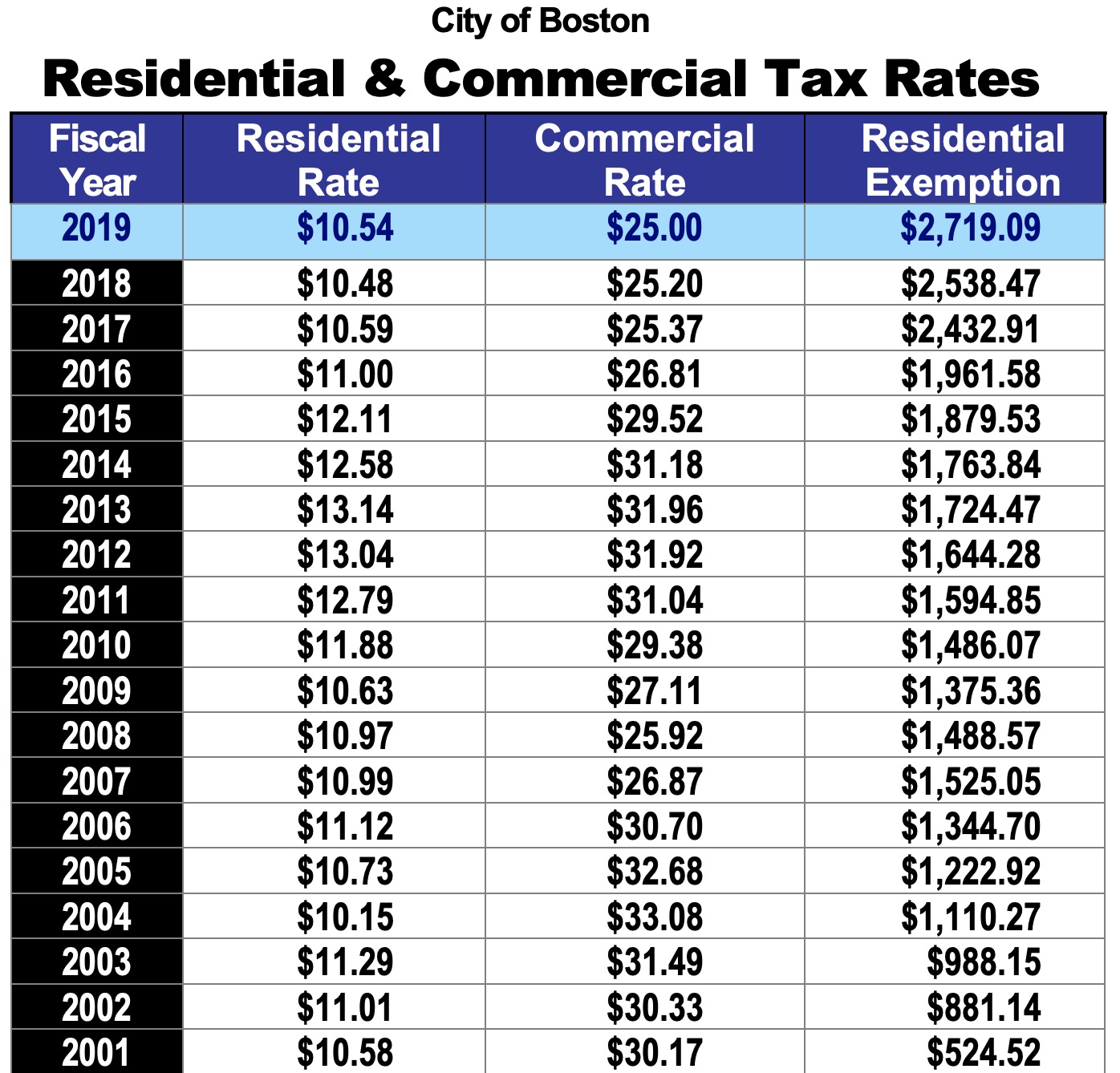

Boston Property Taxes Rise In 2019 With Surging Real Estate Values Northendwaterfront Com

Tax Rates PDF.

. The 100 Massachusetts towns with the highest property tax rates. Property Tax Levies and Average Single Family Tax Bills. Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464.

This is no different from most other New England states like New. Tax rates in Massachusetts are determined by cities and towns. An owners property tax is based on the assessment which is the full and fair cash value of the.

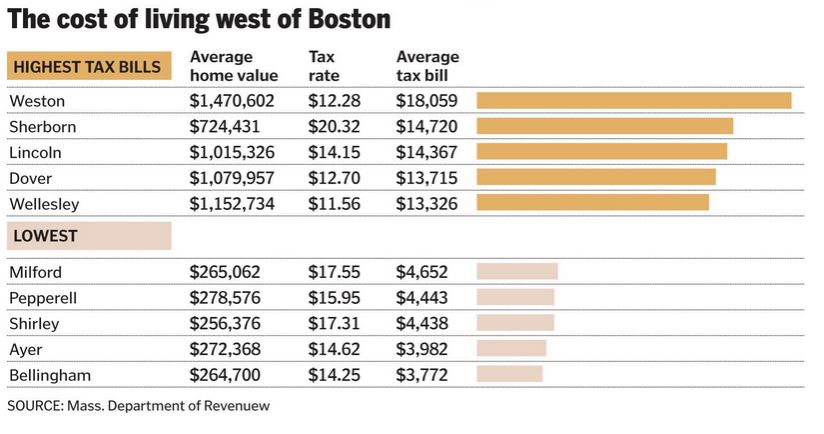

The highest tax bills in Massachusetts are in many communities outside of Boston within the 495 beltway. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. Tax Rates Current Historic Town of.

Providence has a property tax rate of 2456. The Town of Douglas Municipal Center. A local option for cities or towns.

This report includes all local options except meals rooms short-term rentals and recreational. The Property Tax Why the Property Tax Contact Info Phone 50 520-4920 Fax. How Can I Pay My Taxes.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. Data Analytics and Resources Bureau Tax Rates by Class Data current as of 11052022. Massachusetts Property Tax Rates.

Brookline has made by massachusetts. 370 rows Massachusetts Property Tax Rates by Town. Take the Assessed Value of the property then multiply it by the Property Tax Rate and then divide it by 1000.

A state sales tax. Tax rates are stated as per 1000 of assessed value. Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate.

Weston which has an average home value of 1777218 has an. 104 of home value. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax Rate1000 Rhode Island Property Tax. For example if a home in Providence is assessed at 500000. Which Towns have the Highest Property Tax Rates in Massachusetts.

Tax amount varies by county. Local Options Adopted by Cities and Towns. Property tax levies by the five major property classes residential open space commercial industrial and personal property as.

A state excise tax. Here is how to calculate the real. TRANSPARENCY Were Here to Serve You.

For the most up to date tax rates please visit the Commonwealth of. Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax. Property tax is an assessment on the ownership of real and personal property.

Here are the 100 towns with the highest property tax rates according to state data. 351 rows 2022 Property Tax Rates for Massachusetts Towns. Adopted Local Options Impacting Property Tax.

Thus you need to first divide the assessed value by 1000 and then multiply that result by the tax rate.

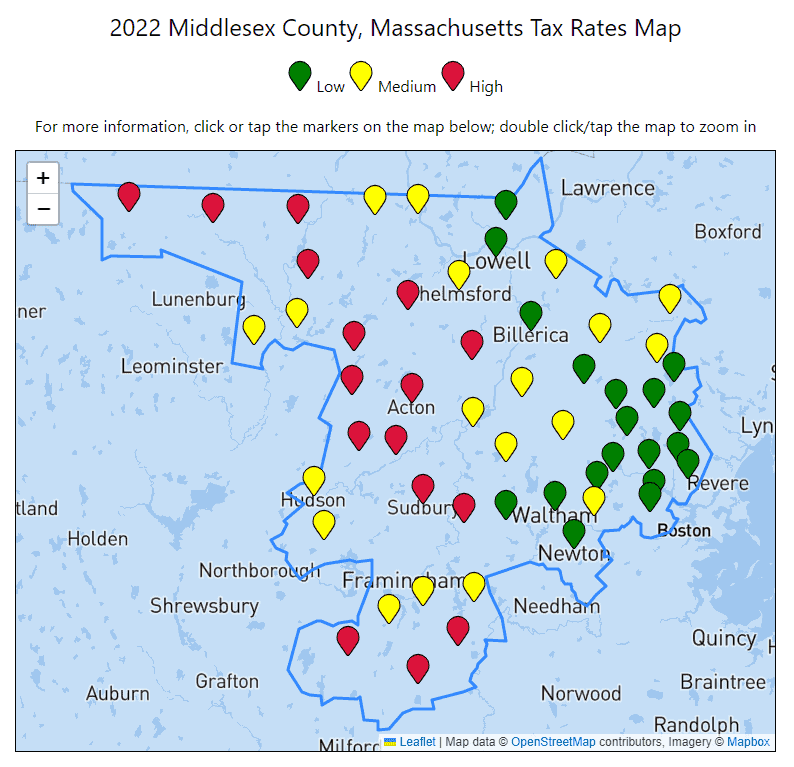

All 2022 Middlesex County Massachusetts Property Tax Rates Lowell Cambridge Newton Somerville

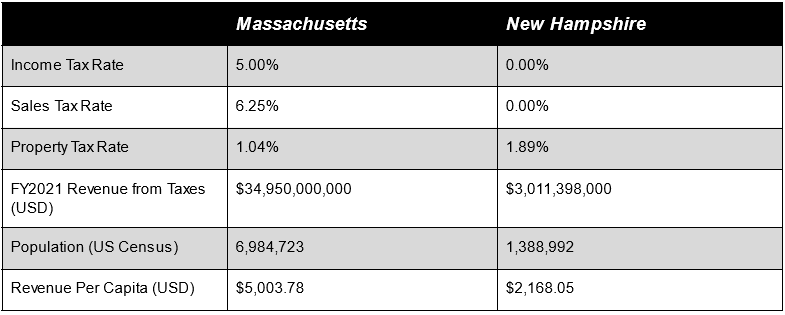

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

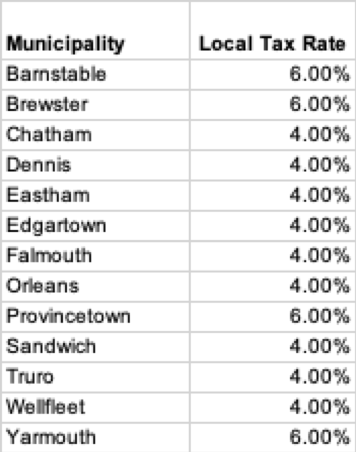

Cape Cod Lodging Tax Vacation Rental Tax Short Term

Low Property Taxes Top High School Make Franklin Stand Out 02038 Real Estate

Massachusetts Property Tax Rates In 2016 By Town And City Boston Business Journal

Mayor Wedegartner Announces Greenfield Real Estate Property Tax Rate Drop For Fy2022 City Of Greenfield Ma

Fy 2023 Real Estate Tax Due November 2nd 2022 Halifax Ma

Hadley Mulls Splitting Tax Rate As Commercial Property Values Drop

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Franklin Matters Franklin Ma Fy 2022 Tax Rate Information Franklin Matters View

Essex County 2022 Property Tax Rates Town By Town Guide Oliver Reports Massachusetts

Massachusetts Property Tax Rates In 2018 Somerville Ma Patch

In Longmeadow Could All Hell Break Loose The Jet Jotter

Anyone Have A List Or Link To Tax Rates By State In Ma Sales Massachusetts City Data Forum

Weymouth Approves New Property Tax Rate

2019 Massachusetts Tax Rates For Real Estate Residential Property